Expected Excess Treasury Returns for the year ahead (April 2018)

I have decided to report some simple expected bond return decompositions. I say simple because my preferred decompositions rely on Bloomberg data which I do not currently have access too.

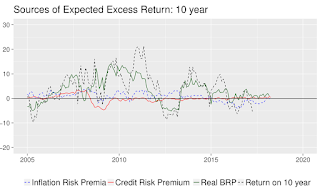

The excess return decomposition table gives us an estimate of the source of the 1-year ahead expected returns from buying a treasury bond today and unloading it in April of 2019. I have several estimates for the real bond risk premium with the average expected excess real return coming in around 2.3% for the ten-year treasury. Excess returns are returns in excess of the 1-yr treasury.

Inflation compensation is pitiful and is effectively nil. The expected return from credit/liquidity covariances is about .5% for the 10-year. Based on this decomposition the expected excess return for the 10 year treasury is 3%, and the total expected return is 4.7%.

A pdf with more plots and technical details is available upon request and a $5 donation to the GoFundMe.

The excess return decomposition table gives us an estimate of the source of the 1-year ahead expected returns from buying a treasury bond today and unloading it in April of 2019. I have several estimates for the real bond risk premium with the average expected excess real return coming in around 2.3% for the ten-year treasury. Excess returns are returns in excess of the 1-yr treasury.

Inflation compensation is pitiful and is effectively nil. The expected return from credit/liquidity covariances is about .5% for the 10-year. Based on this decomposition the expected excess return for the 10 year treasury is 3%, and the total expected return is 4.7%.

A pdf with more plots and technical details is available upon request and a $5 donation to the GoFundMe.

I use the Survey of Professional Forecasters 10-yr CPI forecast to represent long-term inflation expectations, and the Philadelphia Fed Survey of Manufacturing Future Prices Paid as the short-term inflation expectation/ risk premium. The term structure is priced with linear regressions. The methodology is very similar to the one found here.